Wealth management is an investment advisory and financial solutions provider service that caters to a wide array of clients including affluent individuals and families with high net worth. As per reports, there is approximately $78 trillion of assets in motion for wealth managers to capture. This is underpinned by the global expansion of the affluent middle class, an increase in the number of women with wealth, and the wealth created by business ownership. Traditional methods of wealth management no longer hold water and wealth managers are forced to make a significant shift in their strategy and approach.

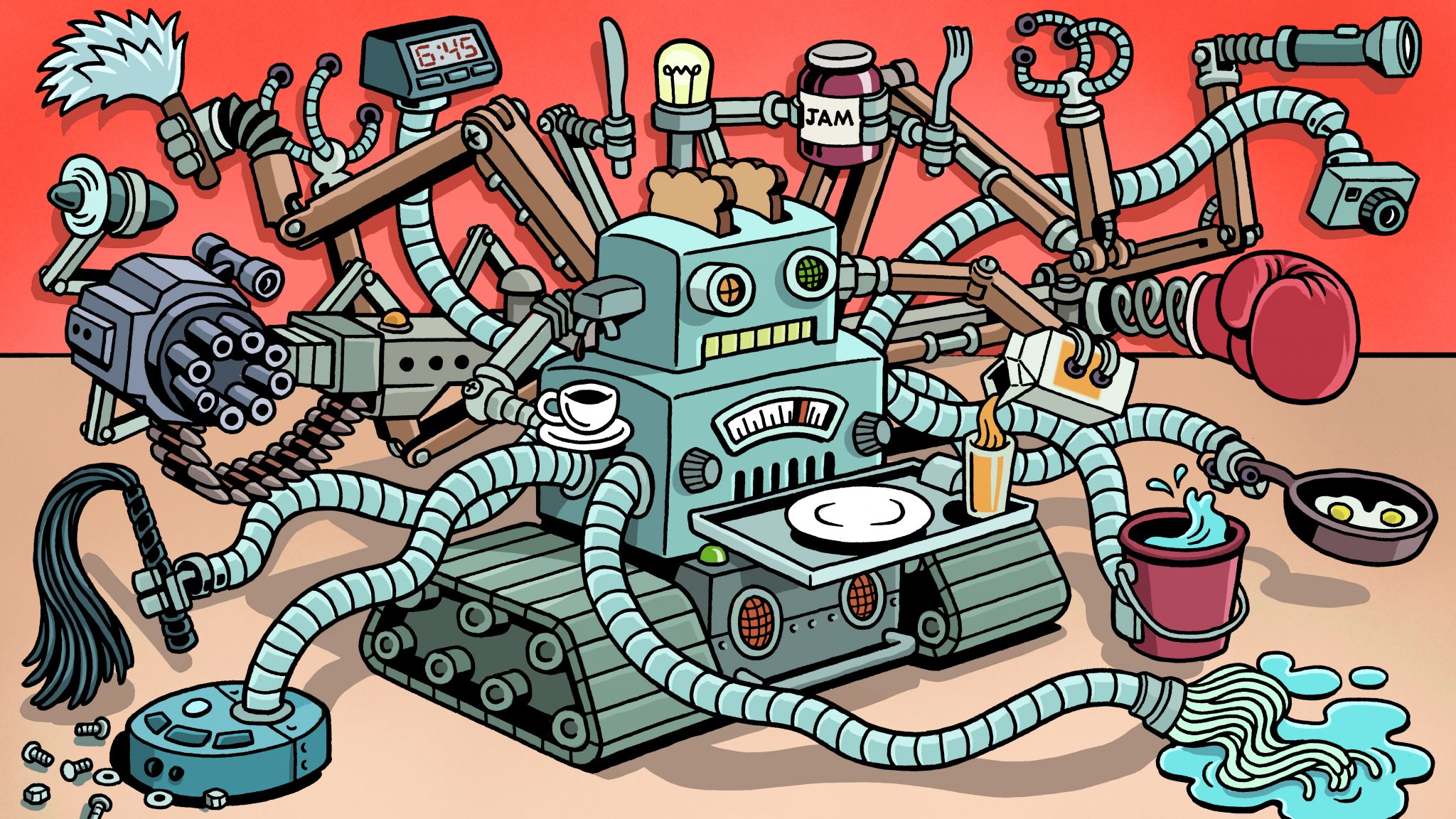

In such a scenario, there is a brilliant opportunity to capture more value using artificial intelligence. AI can help wealth managers smoothly transition from theory to execution. The need to adopt artificial intelligence in wealth management is driven by the success of wealth management technology and the entrance of young tech-savvy modem wealth managers. The increasing amount of data shaping the future of the industry. Most modern wealth managers now have a digitally weak point for work.

AI in wealth management

The wealth management industry is data-rich and relies heavily on the data parsing process, generally performed by humans. Several banks and wealth management services such as Vanguard, Fidelity, Morgan Stanley, and more are looking to embed artificial intelligence in their work and financial advisory services to eliminate human wealth advisors completely or much more to commonly augment their efforts.

To begin with, artificial intelligence tools help identify investment preferences and provide personalised and curated advice for the client. It tells the wealth manager what the client’s attitude towards risks is. Moreover, it saves the time of the wealth manager by parsing data and presenting them in the context of relationships within customers, markets, products, and client profiles. Furthermore, when you work with an algorithm, no advice and decision are instinctive. Such softwares are highly regulated and are mandated to provide proper reasoning for any advice.

At large firms managing massive portfolios, wealth managers might see a reduction in time, costs and an escape from mundane tasks that would involve repetitive data interrogation if AI softwares are used to monitor data to track risks and exposure. They can provide reasoned recommendations after considering clients’ preferences, financial trading trends, and advisory services that human advisors can’t match. Most managers see it as an opportunity to get ahead in the race by moving in the right direction and adopting AI over the next two years.

Use cases

Morgan Stanley, a market leader in wealth management, has the most extraordinary AI intergenerational advisory infrastructure. It uses machine learning algorithms to identify investments of interest and relevance. However, the company understands that people have been sceptical about the tech applied to the sensitive field of money management, where trust is the key to relationships. Jeff McMillan of Morgan Stanley said, “There is a perception that these tools are suitable for the mass affluent segment and not the ultra-high net worth space. The argument is that such populations are too small for a trustworthy recommendation. But we can drive specific opportunities based on individualised client behaviour”.

Vanguard has not applied artificial intelligence but does leverage technology to assess risks. The program it uses leverages simple algebra to translate the questionnaires to investment percentages. The company wants to focus on the end goal, and that is to finance retirements. It uses Monte Carlo simulations for that purpose, determining what the probability of the client outliving their money is. The programme recommends the steps for portfolio rebalancing, but nothing is executed without client or manager approval.

Wealthfront, on the other hand, recommends its clients artificial intelligence generated robot advice. The advice has its perks; it is far cheaper than human advice, just 0.15 per cent of the investment, far less than the one per cent human price. It also makes free recommendations for financial advice below $5000. Its advice is based on a set of questionnaires translated into a customised investment portfolio further analysed by the algorithm.

Wrapping up

Many firms are looking to add artificial intelligence to their way of business. Such algorithms create better value and make service more reliable. When such management softwares are deployed, they significantly improve the value they create for clients. They cover an overall vast spectrum involving user journey analytics, candidate screening, documents data extraction and so on. Furthermore, they also improve the user experience. The use of NLU and NLP interfaces dramatically increases client engagement.